Are European Stress Tests Stressful Enough?

We are huge fans of stress tests. In many ways, they are the best macroprudential tool we have for reducing the frequency and severity of financial crises.

The idea behind stress tests is simple: see if all financial institutions can simultaneously withstand a major negative macroeconomic event—a big fall in real output, a large decline in equity and property prices, a substantial widening of interest-rate spreads, an adverse move in the exchange rate. And, importantly, assume that in response to these adverse circumstances banks have no way to sell assets or raise equity. That is, the stress test asks whether each intermediary can stand on its own without help in the middle of an economic maelstrom. But for stress tests to be effective, they must be truly stressful. The tempest has to be the financial equivalent of a severe hurricane, not just a tropical storm.

This brings us to the latest European Banking Authority (EBA) 2016 stress tests. As we mentioned recently, the European financial system may be the biggest source of systemic risk globally. So, these tests are important not just for Europe, but for the world as a whole. Unfortunately, they just aren’t severe enough, so there is little reason to be confident about the resilience of European finance.

To summarize the published results, the EBA concludes that, with the exception of Deutsche Bank, all of the largest European institutions meet the 3% leverage ratio requirement throughout the three-year simulated stress episode. And, at 2.96%, even Deutsche Bank comes close. But, as we see it, a capital-asset ratio of 3% probably isn’t sufficient to avoid runs in a crisis. While these banks may meet a weak regulatory test, as the more than 40% decline of bank equities over the past year implies, they do not meet the market test. (Deutsche Bank’s stock price-to-book ratio is currently less than 0.25, with the remainder of the largest banks examined at less than 0.75.) And beyond that, there is good reason to doubt that banks are as well capitalized as the EBA’s results indicate.

To see why we are skeptical, let’s compare the EBA stress scenario to those used by the Bank of England and the Federal Reserve. We start with the difference in their assumptions about equity market performance. In the EBA’s severe scenario, European equity prices drop by only a bit more than 25%. In contrast, the Bank of England assumes that the U.K. and U.S. equity markets both fall by more than 40%, while the Federal Reserve’s severely adverse scenario builds in a 51% crash in the Dow Jones Industrial Average. The U.K. and U.S. tests are both consistent with the plunge of more than 40% in global equities that actually occurred in 2008. The European test is not. (For the record, to make comparisons such as these straightforward, we advocate a common and exhaustive disclosure standard for both the scenarios and the results of regulatory stress tests.)

The table below shows that property price assumptions used by the EBA also appear relatively benign. While we do not have comparable data for the U.S. test, the Bank of England’s stress scenario assumes that residential and prime commercial property prices in the United Kingdom will fall by much more than the EBA assumes they will.

Stress test scenarios for property prices in the Euro Area and United Kingdom

Note: Own authority scenarios are shaded. Sources: European Banking Authority, Bank of England, and authors' calculations.

And the fundamental economic assumptions reveal a similar pattern. The EBA assumes that, in 2018, euro-area real GDP will be 6.8% below their baseline projection. In the chart below, you can see that this assumption (the thick black line) is slightly more stressful than the Bank of England’s scenario for the euro area (the blue line), but generally less aggressive than either the actual 2007-2010 history (the gray line) or the path assumed for the euro area in the Federal Reserve’s 2016 CCAR test (the red line).

Comparing the EBA stress test scenario for Euro Area real GDP

Sources: European Banking Association, Bank of England, Federal Reserve, and authors’ calculations.

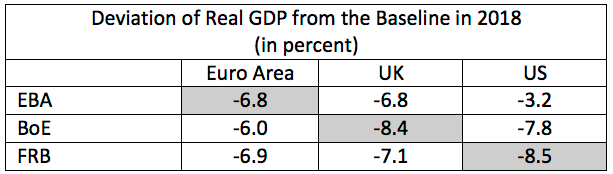

Looking more closely, we can compare the assumptions that the EBA, Bank of England and Federal Reserve make about growth in the other regions. The following table shows that there is a tendency for the EBA assumptions for growth in the United Kingdom and the United States to be stronger than the authorities in those countries assume about themselves. (Banking system health also is crucially dependent on changes in risk spreads. Unfortunately, only the Bank of England publishes their assumptions for these, making it impossible for us to construct a comparison.)

Stress test scenarios for real GDP in the Euro Area, United Kingdom and United States

Sources: European Banking Association, Bank of England, Federal Reserve, and authors' calculations.

So, our first conclusion is that the EBA 2016 scenarios are suspect. (In a new research piece that re-estimates European banks’ capital shortfall under the 2016 U.S. CCAR standards, Acharya, Pierret and Steffen reach a similar judgment.)

As a matter of process, one would think that coordination and cooperation on development of these scenarios is critical to the accuracy and credibility of the results. Why would European and U.S. regulators construct scenarios for the United Kingdom that are systemically less severe than the ones used by the Bank of England for their own economy? The resilience of the global financial system requires ensuring that financial difficulties in one jurisdiction do not spillover into others (for an elaboration of this view, see here). Properly designed stress tests, with assumptions that are both consistent and sufficiently severe, are a key tool officials have to do this.

Returning to the EBA results, we can ask how far off they are from a truly severe test. Here, we turn again to the NYU Stern School V-Lab’s SRISK measure, about which we have written on numerous occasions. As its creators emphasize, SRISK is a market-based measure designed to provide timely information that is very similar to that of a stress test. Combining data from three sources—the V-Lab, the FDIC, and the EBA—we can impose an SRISK test on the eight European banks with at least $1 trillion in assets for which all three data sources are available. The test allows us to compare initial and stress leverage ratios in the event of a global equity market drop of 40% (equivalent to the collapse in 2008 and larger than the 25% decline assumed in the EBA stress test).

The results are plotted in the following chart. For each of the eight banks, we report the initial capital-asset ratio provided by the EBA (the red diamond), the final EBA stress level (the black bar), the initial market-value implied capital-asset ratio under the SRISK test (the blue diamond) and the SRISK-implied stress ratio of capital to assets (the gray bar). The differences between the two cases is stark: not only is the initial capital-asset ratio reported by the EBA generally higher (often by quite a bit), but the drop as a result of the stress test is smaller. For the big banks widely viewed as short of capital—the three French banks, Barclays and Deutsche Bank—the EBA results look particularly misleading. Under the SRISK test, stressed capital-asset ratios fall below 1% for Crédit Agricole, Barclays and Deutsche Bank; and below 2% for BNP Paribas and Société Générale. For these five banks to reach even the 3% capital ratio requirement that the EBA views as adequate, they would each need to raise between $24 billion and $40 billion each. This is at odds with the EBA’s clean bill of health. Of course, not all banks are in such bad shape. The SRISK test that we devise shows HSBC easily meeting the 3% regulatory minimum.

Stress Test Capital-Asset Ratio Comparisons for the Largest European Banks

Sources: NYU Stern School V-Lab, FDIC, EBA and authors’ calculations.

To put these numbers into context, we can impose a comparable SRISK test on U.S. banks. As we explain in a previous post, differences in accounting standards imply that we need to use a higher capital ratio threshold. For this reason, we set the minimum standard for the United States at 5½%, rather than the 3% used for Europe. Applying these two benchmarks, pre-crisis, the aggregate shortfalls implied by SRISK calculations for Europe ($161 billion) and the United States ($150 billion) were of similar magnitude. While both numbers have risen over time, their difference has grown substantially. A stress scenario involving a 40% plunge of global equity markets would now leave the European banking system with a $600 billion capital shortfall, more than 2.5 times the $230 billion estimate for U.S. banks. (In Table 2 Panel A of their paper, Acharya et al show that an SRISK test using 5.5% as the capital-asset threshold for European banks results in a whopping aggregate capital shortfall of about $750 billion at the current exchange rate of US$1.11 per euro. They also note that the rankings of European banks’ capital shortfalls estimated under the European and U.S. approaches are strongly negatively correlated, while those under the SRISK and CCAR tests are positively correlated.)

By our count, this is the sixth time that European banks have undergone stress tests since the initial exercise in 2009 conducted by the EBA’s predecessor, the Committee on European Banking Supervisors. The inadequacy of the first four—prior to the 2014 creation of the Single Supervisory Mechanism (SSM) under the European Central Bank—was sometimes quickly revealed by the need for bank rescues. The 2014 test that accompanied the SSM’s asset quality review was generally well received, but skepticism remained.

We doubt that the 2016 test results will counter this skepticism. But a truly stressful test probably would have just confirmed the view that is already incorporated in low bank equity prices: unless European banks increase their capital substantially, they will not weather another big storm without official assistance.